ERS reporting doesn’t apply to everyone, we know that, but as it is such an important thing to get right, if you think you may be affected – or you have clients/contacts or friends who might be please do forward on this email to make sure they don’t get tripped up!

HMRC require all companies to notify them of a wide range of transactions in shares and securities. This is drawn widely and includes shares, share options, debentures and loan stock etc held by an employee/officer or a person connected to them.

Companies must take action to comply with these obligations to minimise the risk of losing valuable tax reliefs or incurring penalties.

Who

The notification requirement covers any company that operates either an HMRC tax-advantaged plan or non-tax advantaged plan for employees, directors, or other similar roles. It also covers companies in which those individuals have acquired shares or securities directly. In most cases, any share transactions involving employees, directors, or similar roles are reportable.

With the online registration and notification process, only the company can perform the initial registration of its share plans (although we can guide you through the process). The Employment Related Securities (“ERS”) service is part of the existing PAYE online service and companies can select to add this service whilst logged onto the HMRC website: https://online.hmrc.gov.uk/paye.

Once the company has completed its online registration, if you wish, we can enrol as agent for the company in relation to ERS online services (this would not disturb your current Payroll Provider’s agent status with HMRC). We can then assist with online filing of ERS annual returns.

When

The deadline to register the creation of a share plan or the issue of shares etc. within the tax year to 5 April 2024, as well as the submission of the separate ERS annual return online with HMRC, is 6 July 2024.

However, as registration for the online service can take at least a week, it is recommended to register well in advance of the 6 July. In addition, if you require us to register as ERS online agents so that we may deal with the relevant annual return notifications this may take three weeks or more and therefore we recommend that you inform us as soon as possible. This will avoid the risk of late filing and the incurring of automatic penalties.

If you would like us to assist with your filings, you need to let us know before 31 May 2024. If you contact us after that date, we cannot guarantee your returns will be submitted on time.

What

Common events that require reporting under the ERS Other return are (note that this list does not cover all reportable events):

- the issue or transfer of securities;

- the grant or exercise of share options or of other rights to acquire shares;

- the assignment or release of taxable securities options for consideration;

- a share for share or share for loan note exchange;

- the share transactions on a management buyout;

- a rights issue or a bonus issue to employees by an employing company;

- a change in the rights of shares held by employees;

- a sale of securities that are ‘restricted’ where certain elections have not been made.

Where HMRC tax-advantaged plans are in place, they have specific returns that need to be completed instead by the same deadlines noted above. If an EMI option plan has been in place in the period, the EMI notification of grant should also have been made online within 92 days of grant.

Penalties

A return must be submitted for every share plan registered, even if it is a nil return. HMRC will not issue notices to file or reminders, it is the responsibility of the company to first register online so that the appropriate annual returns/ notifications may then be made.

Any failure(s) may also impact on HMRC’s risk rating for the company and could subsequently result in an unwanted visit from HMRC.

Action

It is widely acknowledged that the process of concluding whether or not there are transactions to report and how to accurately complete the forms is complex; a 52-page completion guide on the HMRC website relating to ERS Other return is testimony to this.

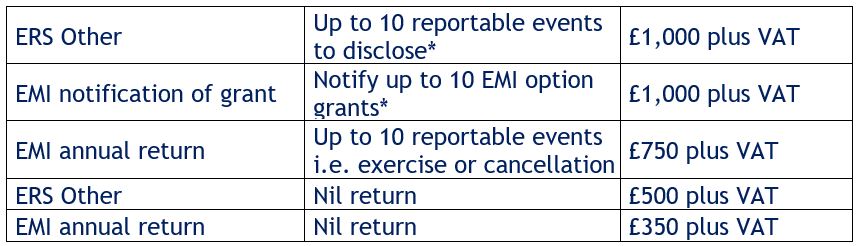

To save the trouble of dealing with this issue, we can assess the filing requirement, assist you with the initial registration process and complete the online annual return submissions. Where we are asked to assist you with this process and we have dealt with your ERS filing in the past, for routine filings, our fees would be as set out below:

For more challenging situations, where we are undertaking the work for the first time, or where you have undertaken one or more of the more complex events noted below, we will provide you with a specific quote for your circumstances because more work is likely to be required.

*For these purposes, “reportable events” are limited to share subscriptions/ purchases and option exercise. If you have undertaken more complicated share transactions (e.g. acquisition of loan notes and/or convertible securities, or events have occurred that could result in reporting obligations under the artificial enhancement, reduction of market value rules, the post-acquisition benefit rules or where restrictions applying to shares have been removed or altered) then we shall provide you with a tailored quote for undertaking the work.

If there are more than 10 reportable events in the period then we will discuss the scope of our work and agree a fee basis with you.

If you would simply like assistance with the initial process of registering the applicable ERS plan, thus removing any uncertainty you may have on how to meet the filing obligations, our proposed fee would be £250 plus VAT.