The R&D tax relief landscape in the UK is set for a seismic shift, with the proposed introduction of a single, unified scheme for accounting periods commencing on or after 1 April 2024.

This article considers the new scheme, analysing its motivations, implications for different company types, and potential outcomes for those involved.

Why the Change?

The current two-scheme system (SME and RDEC) presents complexities and inconsistencies. The government views a unified scheme as an opportunity for significant tax simplification, boosting visibility and attracting more companies to claim the benefit. Additionally, merging aims to:

- Reduce fraud: The SME scheme currently bears the brunt of fraud concerns, with figures suggesting a much higher level compared to the RDEC scheme. A unified approach with stricter guidelines is considered to be a powerful deterrent.

- Deliver better value: The government has a target for R&D investment to reach 2.4% of GDP by 2027. Studies suggest the RDEC scheme is more effective in incentivizing private investment than the SME scheme.

- Increase transparency: The “above-the-line” credit system of the RDEC scheme offers greater visibility for investors and decision-makers, potentially attracting more R&D-focused companies.

What are the Changes?

Notes

Merged Scheme:

Applicable to all companies regardless of size for accounting periods starting on or after 1 April 2024.

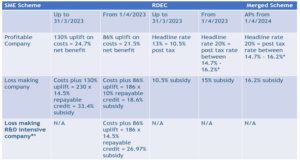

* The amount of tax relief recoverable under the RDEC/Merged scheme depends on the company’s profits and chargeable tax rate. Here’s a quick breakdown:

Large companies (25% tax rate): 15% relief

Small companies (19% tax rate): 16.2% relief

Companies in the marginal rate band (26.5% tax rate): 14.7% relief

**R&D intensive companies: Companies that invest at least 40% of their expenditure in R&D activity (30% starting April 2024).

Boosting Benefits for Loss-Making Companies

The combined scheme, for accounting periods starting on or after 1 April 2024, mirrors the operation of the R&D expenditure credit (RDEC) scheme in that all companies, regardless of their size, will receive a tax credit equal to 20% of their R&D expenditure that can be recognised “above the line” as taxable revenue, giving it greater visibility in their accounts.

Under the new scheme, the notional tax charged on R&D expenditure for loss-making companies drops from 25% to 19%. This translates to a net R&D benefit of up to 16.2% for every qualifying £1, compared to the 15% for profitable companies. This represents a substantial boost for innovative start-ups experiencing losses, providing vital fuel for their R&D endeavours.

A Two-Tiered Approach: The R&D-Intensive SME Scheme

Running alongside the combined scheme is a separate scheme for R&D-intensive SMEs**. This unlocks enhanced relief rates, offering a potential cash benefit of up to 26.97% per £1 of qualifying expenditure. This significant financial incentive acts as a powerful catalyst for highly innovative smaller companies.

Clarifying Uncertainty: Contracted-Out R&D

Previous uncertainty surrounding who can claim for contracted-out R&D has been clarified in the new scheme. In the future, the company who contracts out the R&D to the third party will be the one to claim R&D tax relief, to include the subcontracted expenditure. The third party will not be able to make a claim unless the company contracting out is not subject to U.K. corporation tax or if it can demonstrate that the R&D has been initiated as part of its own project (even though contracted to provide goods or services).

Sight of the contractual arrangements between the parties will be extremely important to assess the commercial arrangements between the parties and determine the contractual rights and responsibilities.

Streamlining the Process: Subsidised Expenditure

The removal of the “subsidised expenditure” legislation simplifies the scheme for companies receiving grants or third-party funding. However, the contracted-out R&D rules still apply, necessitating careful consideration of contractual arrangements.

The impact of the changes varies across different sectors and company types:

Winners:

- Large manufacturing and pharmaceuticals companies who previously made claims under RDEC and were precluded from claiming for subcontracted R&D to companies. These companies can now include subcontracted expenditure as part of their claims.

- R&D-intensive SMEs.

Losers:

- Consulting and advisory sectors may see claims decrease due to restrictions on claiming for subcontracted work.

- Construction and energy sectors have mixed outcomes, with main contractors/developers gaining but subcontractors potentially losing out.

- Contract manufacturing companies could also lose out in some cases, depending on the nature of their contracts and their level of R&D involvement. This is because the ability to claim R&D tax relief for subcontracted activities depends on who sets the direction and bears the risk for the R&D.

Closing Thoughts: Adapting to Thrive

The proposed unified R&D scheme presents a dynamic representation of challenges and opportunities. While companies need careful planning and adaptation to navigate the new landscape, the potential benefits for R&D-focused businesses are considerable. By understanding the intricacies of the scheme, proactively preparing for the transition, and utilising available resources, businesses can leverage the streamlined framework to fuel innovation, navigate potential pitfalls, and ultimately propel themselves towards a new era of R&D success.