Innovation is key to the Government’s strategy for the UK to become a world-leader in science, research and innovation and to become a global innovation hub by 2035.

The UK’s innovation strategy was set out in 2021 with 4 key pillars:

- Unleashing business – fueling businesses who want to innovate

- People – make the UK the go-to place for innovation talent

- Institutions and places – Ensure the UK’s R&D and innovation institutions serve the needs of businesses and places across the UK

- Missions & technologies – stimulating innovation to tackle major challenges

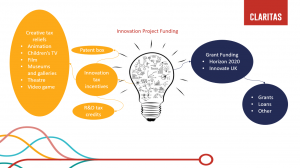

Innovate UK is the Government’s innovation agency and is part of UK Research and Innovation (“UKRI”). Both are tasked with operating and delivering this strategy through the 4 pillars above, and, more specifically, by funding innovative businesses.

One source for innovation funding is through UKRI. UKRI brings together numerous councils that deliver funding to businesses through loans, fellowships grants, and Partnership programs. Claritas works specifically with Innovate UK on grant funding, which complements other work carried out within our Innovation Reliefs team.

Public awareness of R&D Tax credits has risen sharply over the last couple of years and most businesses will now have heard of them. R&D tax credits and grant funding are not mutually exclusive, but there are some intricacies and pitfalls that business owners need to be aware of if you are considering claiming both – the key to avoiding these is discussing any upcoming R&D projects with your advisors in advance of starting the project and grant funding application.

RDEC (R&D Expenditure Credit, mainly applicable to larger companies) are not considered to be a form of state aid, whereas SME R&D tax credits are. Grant funding from Innovate UK is also a form of state aid because it is a public body that is funded by the Government. Broadly, businesses are only allowed to claim one form of notified state aid. There are also de-minimis grants, which are not considered to be state aid because they are below a de minimis threshold.

It is important, therefore, that not only are businesses aware of the existence of R&D tax credits and grant funding, but they are aware of the interaction between the two.

Where a company has received an innovation grant, the amount of SME R&D tax credit relief (up to 33%) they can receive will be restricted – the company can still benefit from the RDEC scheme, albeit they will receive a lower rate of tax benefit (10.5%).

The interaction between SME R&D tax credits and innovation funding at the start of a project can broadly be split into 3 scenarios:

- Non-project specific state aid

- Project-specific state aid

- De-minimis funding

1. Non-project specific state aid

Non-project specific state aid is effectively a grant that is awarded for general activities, or to put it another way, the grant is not ring-fenced for specific activities. This may sound beneficial for businesses because it offers more flexibility on how the funds can be used. There may , however, be a detrimental impact on the availability of SME R&D tax credits of a non-project specific state grant. HMRC require such ‘general’ subsidies to be allocated to underlying expenditure in accordance with the relevant facts. Where this results in any part of the notified state aid being allocated to one or more specific R&D projects, the relief will only be available under the less beneficial RDEC scheme for those projects.

Note that Covid support such as CIBLS and JRS which were provided for general purposes should not impact on the availability of SME R&D tax relief on specific projects.

2. Project-specific state aid

In this scenario, let’s say the company is carrying out numerous R&D qualifying projects and has received a project-specific notified state aid grant in respect of one of those projects. Provided the company meets the usual criteria, costs for the non-grant funded projects would fall under the SME R&D credit scheme (with a tax benefit up to 33%). 100% of the expenditure for the project that received the specific grant would fall under the RDEC scheme (with a tax benefit of 11%).

3. De-minimis funding

Under this scenario, if a company receives less than €200,000 across a three-year period then the grants can qualify as de-minimis aid. From an R&D perspective, this is a good outcome because only the value of the grant (i.e. the R&D expenditure equal to the grant received) falls within the RDEC scheme, and the remainder qualifies for under the SME scheme.

Typically, in the innovation cycle, a grant application will precede the R&D tax credits claim so it is important to consider the impact on R&D claims before the application for innovation funding is started. In addition to this, it is critical that the wording in the grant application around whether the funding will be project-specific or non-project-specific is clear, so as not to compromise any potential claim for R&D tax credits.

Information regarding grants that are currently open for applications can be found here: Opportunities – UKRI

Claritas is in an ideal position whereby it can advise on both R&D tax credits and grant funding so please do get in touch if you have an innovative project in mind that you would like to discuss.