‘It’s My House’ was the second single from Diana Ross’ peerless 1979 album, ‘The Boss’. It’s an understated ballad in which Diana sets out the contents of her house and what makes it hers:

On the table, there sits a rose

Through every window

A little light flows

Books of feeling on the shelf above

Cause it was built for love

There is a very tenuous connection between ‘It’s My House’ and Stamp Duty Land Tax (‘SDLT’) Multiple Dwellings Relief (‘MDR’). As I shall cover, MDR requires there to be the purchase of two or more ‘dwellings’. The First Tier Tribunal (‘FTT’) has recently had to consider what amounts to a ‘dwelling’ for these purposes. Although they’ve stopped short of stipulating that a dwelling has to be ‘built for love’, it’s clear that not just any old ramshackle annexe counts as a dwelling for these purposes. Taxpayers who contend otherwise could be in for a nasty surprise in the form of both tax and penalties.

Why is MDR important?

SDLT on residential property operates as a banding system, with increasing rates of SDLT being applied to each ‘band’ of consideration / transfer value, as below:

| Transfer value | SDLT rate |

| Up to £125,000 | 0% |

| £125,001 – £250,000 | 2% |

| £250,001 – £925,000 | 5% |

| £925,001 – £1,500,000 | 10% |

| Above £1,500,001 | 12% |

So, simply, the more expensive a residential property, the higher the SDLT liability

Where a purchaser acquires two or more dwellings, MDR allows SDLT to be applied to the average price per dwelling. This ‘notional’ SDLT figure is then multiplied by the number of dwellings to give the total liability. This is subject to a minimum ‘floor’ of 1% of the total transfer value. Given high property values, especially in larger cities, this has led to increased interest in MDR claims, both from purchasers and HMRC.

For example, assuming a purchase price of £1,250,000 for a property comprising a main house and a separate ‘granny flat’:

Without an MDR claim, SDLT would be payable as below:

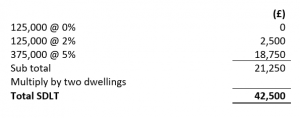

Average price per dwelling = £625,000With an MDR claim based on two dwellings, SDLT would be payable as below:

By making an MDR claim based on two dwellings, there is a saving of £26,250.

There is, however, a potential sting in the tale. The additional 3% surcharge for second homes could apply unless the ‘subsidiary property exemption’ is available to disapply the surcharge. There is also the potential for MDR to be ‘clawed back’ in certain circumstances, but that is outside the scope of this article.

What is a dwelling?

In order to make the correct claim to MDR, it is necessary to identify the number of dwellings that are being purchased. A building, or part of a building, counts as a dwelling if;

- It is used or suitable for use as a single dwelling; or

- It is in the process of being constructed or adapted for such use.

Land that is occupied or enjoyed with a dwelling as a garden or grounds (including any building or structure on such land) is taken to be part of that dwelling.

There is no statutory definition of ‘dwelling’. Caselaw emphasises that the word should be given its normal meaning, with this then resulting in cases that fall either side of the line. Many of these have been in the context of internal annexes and have tended to focus on the degree of separation and privacy from the main property that is necessary to establish a separate dwelling. For example, in Partridge, non-lockable internal doors between the main house and an annexe were held not to provide sufficient security and privacy to establish two separate dwellings.

Even in the case of separate buildings, privacy needs to be considered to determine whether there are two separate dwellings. In Mason the FTT had to consider whether an annexe was a dwelling. Although the annexe was a standalone property, it would need to be accessed through the main house’s garden. The layout of the annexe afforded it little privacy from the main house. The Tribunal considered that this would limit the use of the annexe to family members and friends of the occupiers of the main house. The lack of privacy would not permit it to be occupied by third parties. This was contrary to the purported purpose of the MDR legislation, being the increase in lettable housing stock.

The amenities within a building or part of a building need to meet a minimum threshold to establish a separate dwelling. In Uratemp it was held that . . . a dwelling will, as a minimum, contain the facilities for personal hygiene, the consumption of food and drink, the storage of personal belongings and a place for an individual to rest and sleep. So a dwelling requires kitchen and bathroom facilities, plus storage space, a bedroom and a living area.

The condition of the purported dwelling is also crucial. In Mullane, the question was put as would a reasonable person consider both parts of the property to be dwellings, or suitable for use as a dwelling, without further work being undertaken, other than obtaining appropriate or updated fire and building regulation certificates, to enable the parts of the Property to be let, having regard to the purpose of the relief to increase the accommodation available for letting? Again, this was said to be in accordance with the purpose of MDR, being the increase in the available housing for letting.

In Mullane, the cooking facilities appeared to be unsafe, with the annexe also lacking fire doors in the kitchen area. This was seen as being fatal to the claim that it amounted to a dwelling, due to it not being a in a lettable state, (or a lettable state save the obtaining of the necessary certification).

Although not an MDR case, the FTT in Bewley determined that suitable means that a building must be suitable of being used as a dwelling without alteration at the time of purchase. This is a different test to whether a building is capable of being so used at some point in the future. The FTT observed that ‘no doubt a passing tramp or group of squatters could have lived in the bungalow on the date of purchase’. But the bungalow’s poor condition, including the presence of asbestos and absence of pipework, meant that the FTT had ‘no hesitation in saying that in this case the bungalow was not suitable for use as a dwelling’.

The presence or absence of separate titles, council tax ratings and utilities have not been held to be decisive either way in the recent cases.

The 3% surcharge

Where two or more dwellings are purchased, consideration must be given to whether the 3% surcharge for second homes applies to the ‘additional’ dwelling(s).

In order for the ‘additional’ dwelling(s) to be exempt from the surcharge it must be subsidiary to the ‘main’ dwelling it must fall within the ‘subsidiary property exemption’:

- The additional dwelling(s) must be within the grounds of, or same buildings as the main dwelling; and

- The amount of consideration attributable to the main dwelling on a ‘just and reasonable basis’ is equal to, or greater than, two thirds of the total consideration.

Where an outbuilding is sufficiently separated from another dwelling to fall outside its garden or grounds, this may assist with an MDR claim. It would, however, result in the 3% surcharge being due. Therefore, the position needs to be examined carefully to ensure compliance.

Lost opportunities?

In an ideal world the appropriate MDR claim would be identified prior to the completion of a purchase and reflected in the original SDLT1. This does not, however, always happen. Taxpayers instead often look to make the claim following the purchase. The general deadline for making an MDR claim is 12 months from the submission date of the SDLT1, being 14 days after the completion of the purchase. This gives taxpayers a limited window to revisit purchases and make the appropriate claim.

MDR claims are, however, coming under scrutiny from HMRC. In a recent ‘Talking Points’ webinar on MDR, HMRC’s tone was combative, and seemingly intended to dissuade attendees from making MDR claims. HMRC made it clear they would have no hesitation in challenging spurious MDR claims and issuing penalties where appropriate. Any MDR claim should therefore be robust and capable of being supported should HMRC open an enquiry.