It is nearly 7 years since the corporate losses reforms were introduced from 1 April 2017, which included the concept of ‘carry forward’ group relief. Prior to 1 April 2017, broadly once a group had utilised its current year losses across its members through loss relief claims and surrenders, if it happened to have excess losses remaining after such claims, then the future utilisation of those losses would tend to rely on the specific group member generating the ‘right type’ of taxable profits. This often led to the dreaded ‘trapped losses’ situation, typically where group debt financing was held in a separate entity to the trading operation. Excess interest (non-trade deficit) losses arising and then being carried forward in such a group financing company would habitually remain trapped forever unless the same entity could generate taxable non-trading income itself in future, which was often a rare occurrence! Tax planning around group restructuring exercises to move debt and interest income within a group (with the aim to utilise such otherwise trapped losses), was then further negated by anti-avoidance rules to prevent ‘loss refreshing’ that were introduced from 18 March 2015.

However, the reforms for corporate losses arising post 1 April 2017 addressed this situation going forward by extending the ability of groups to surrender losses that arose on brought forward basis (post 1 April 2017) as well as those arising in a current period. This reform was therefore a welcome and beneficial extension to the group relief rules for many corporate groups, which had been broadly unchanged for over 50 years

So how do we define a group?

The concept of a ‘group’ for these purposes following the 2017 reforms remained unchanged from the historic position for group relief claims:

Two companies are members of a group where one is the ‘75% subsidiary’ of the other or they are both ‘75% subsidiaries’ of a third company.

A company is a 75% subsidiary of another company where all three of the following conditions are met:

- The parent company has at least 75% direct or indirect beneficial ownership of the ordinary share capital of the company.

- Those shares entitle the holder to at least 75% of the distributable profits that are available to the equity holders.

iii. Those shares entitle the holder to at least 75% of the company’s assets that are available for distribution to the equity holders on a winding up.

The second and third conditions introduce the concept of an ‘equity holder’ that extend beyond just the persons holding ordinary shares in a subsidiary. An equity holder of a company includes any person who is a loan creditor of the company in relation to a loan which is not a normal commercial loan.

It follows that a loan creditor of a loan that is a normal commercial loan is not an equity holder. A loan is a normal commercial loan if, generally speaking:

- it cannot be converted to shares or securities (except for shares or securities in a company’s quoted parent);

- the interest payable under the loan is not calculated by reference to the results of the company or (subject to what is said below) the value of its assets;

- the interest payable does not exceed a reasonable commercial return; or

- the lender is not entitled to be repaid more than was originally lent.

Ordinary share capital is owned indirectly by a company if it is owned through other companies and the amount of any share capital owned indirectly is ascertained by multiplying through a series of shareholdings.

Therefore, whilst in a 100% owned group that only holds normal commercial loans the answer as to whether to companies are entitled to claim and surrender current year and carry forward losses between them should be straightforward, where equity holdings by corporates have been diluted, say for example through commercial incentives for employees/management, the calculation to arrive at an answer can be much more complex.

Take the following example:

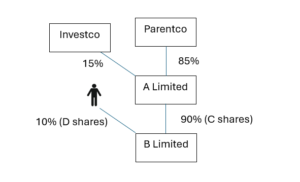

Parentco holds 85% of the ordinary share capital of A Limited and there is a single class of shares in A Limited. An unconnected company, Investco, holds the other 15%. All borrowings and creditors in A Limited are considered normal commercial loans and there are therefore no other equity holders of A Limited.

A Limited also has a subsidiary, B Limited in which it holds 90% of the ordinary share capital (C Shares), with the other 10% held by management (D Shares). The C and D shares have equal voting rights, but the D Shares held by management are entitled to a preferential right in B Limited through its Articles to the first £10,000 of any distribution or the assets available on a winding up. All borrowings and creditors in B Limited are considered normal commercial loans and there are therefore no other equity holders of B Limited.

On the beneficial ownership test Parentco holds at least 75% of the ordinary share capital of both A Limited and B Limited; 85% in A Limited and 76.5% (= 85% x 90%) in B Limited.

However, both the distributable profits and assets on a winding-up tests must be considered on an accounting period basis each year. For instance, take a situation where B Limited has net assets of £1m at the end of an accounting period but in the same financial year its annual accounting profits were only £80,000.

Considering the assets test first. On a winding up of B Limited, A Limited would have a right to £900,000 (with management taking £100,000 including their preferential sum of £10,000). Parentco would then have a right to 85% of £900,000 through its interest in A Limited ie £765,000. So Parentco has a right to at least 75% of the assets of B Limited, 76.5% in fact.

However taking the rights to distributable profits based on £80,000 of profits made in a year by B Limited, rather than A Limited receiving a £72,000 (£80,000 x 90%) dividend, because of management’s preferential right to the first £10,000 A Limited could only receive £70,000 out of profits of £80,000. Following through the chain, Parentco would only have a dividend right to 85% x £70,000 = £59,500. This would be insufficient for Parentco to have an entitlement to at least 75% of the profits of B Limited that are available: 75% x £80,000 = £60,000.

So in such an example, although Parentco and A Limited form a group for these purposes, B Limited does not also form a group with Parentco and consequently losses cannot be surrendered between Parentco and B Limited for this particular example.

Note that both the assets and profits conditions are tested on an annual basis, so in this scenario Parentco and B Limited could form a group one year but not the next (depending on the level of B Limited’s distributable profits).

Like most aspects of taxation, the ‘devil is in the detail’, particular where there are minority shareholders in a corporate group scenario, and care should always be taking in reviewing the 75% subsidiary conditions to ensure there are no unexpected surprises where group relief is assumed to apply.